VALUE ADDED TAX IN UNITED ARAB EMIRATES

Tax is a word that can be

daunting to many, but it's essential to understand its purpose. Taxation,

specifically value-added tax or VAT TAX in UAE, is a crucial and essential

concept to comprehend to understand in business operations. VAT is a

consumption tax applied to a product at each production stage before the final

sale. For example, a computer manufacturer is taxed on all materials and

supplies they bought to create and produce the product before it is sold.

Customers pay the VAT, calculated as a percentage of the total sale price,

which the company already paid during production. It is important to note that

VAT is not an extra expense or an add-on to the sale price but a mandatory

requirement in the UAE. Understanding VAT's fundamental principles can help

individuals and businesses manage the tax more effectively and avoid issues

with compliance.

Value Added Tax (VAT) is an

indirect tax imposed on the consumption of goods and services in the United

Arab Emirates (UAE). Introduced on January 1, 2018, VAT has become an integral

part of the UAE's tax system. Here are the fundamental principles you need to

know about VAT in the UAE.

1. What is VAT?

VAT

is a consumption-based tax that is levied at each stage of the supply chain,

from the manufacturer to the retailer and finally to the end consumer. It is

calculated on the value added to a product or service at each stage of

production or distribution.

2. VAT Registration:

Businesses

with an annual turnover exceeding the mandatory threshold of AED 375,000 must

register for VAT. However, businesses with an annual turnover between AED

187,500 and AED 375,000 have the option to register voluntarily. Once

registered, businesses receive a unique Tax Registration Number (TRN) and must

comply with VAT regulations.

3. Standard and Zero-Rated VAT:

The

standard VAT rate in the UAE is 5%. However, certain goods and services are

classified as zero-rated, meaning they are subject to a VAT rate of 0%.

Zero-rated goods include exports, international transportation, and certain

healthcare and education services. Businesses dealing with zero-rated supplies

can still reclaim the input VAT they paid on their purchases.

4. VAT Returns and Payments:

Registered businesses are

required to file VAT returns on a regular basis, typically quarterly. These

returns provide details of the VAT collected from customers and the VAT paid on

business expenses. If the output tax exceeds the input tax, the business must

pay the difference to the tax authorities. Conversely, if the input tax exceeds

the output tax, the business may be eligible for a refund.

5. Impact on Businesses and Consumers:

VAT

has had a significant impact on businesses and consumers in the UAE. For

businesses, it has required the implementation of accounting systems and

processes to track VAT transactions, as well as adjustments to pricing

strategies. Consumers have experienced a slight increase in the prices of goods

and services, with the extent of the impact varying depending on the nature of

the goods or services.

6. Compliance and Penalties:

Ensuring

compliance with VAT regulations is crucial for businesses in the UAE.

Non-compliance can result in penalties, fines, and even legal action. It is

essential for businesses to maintain accurate records, issue correct tax

invoices, and submit VAT returns on time to avoid penalties and maintain good

standing with the tax authorities.

VAT has become an integral

part of the UAE's taxation system, contributing to the government's revenue

diversification efforts. With proper understanding and compliance, businesses

and individuals can navigate the VAT landscape effectively, while contributing

to the country's economic growth and development.

It is recommended to refer to

the latest official sources or consult with a tax professional for the most

up-to-date and accurate information on VAT in the UAE.

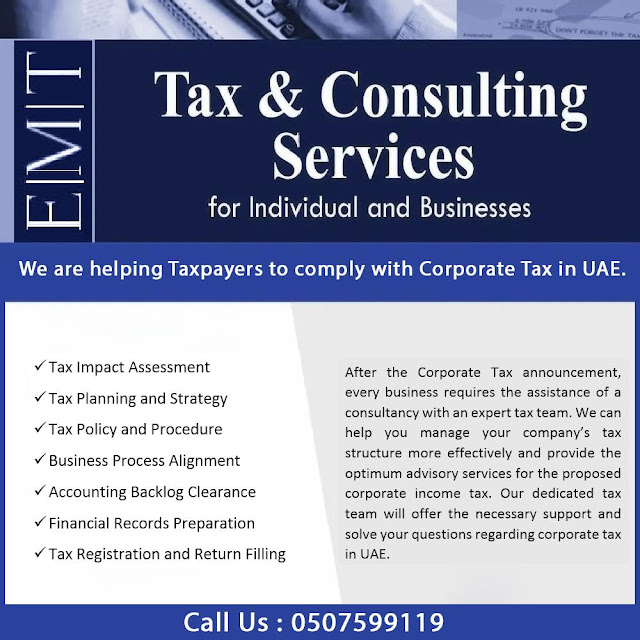

Why consult with a tax

professional:

VAT consultants in Dubai play a crucial role

in guiding businesses and individuals in complying with the Value Added Tax

(VAT) laws in the Emirate of Dubai. They deal with all aspects related to

taxation, ranging from registration to filing and ensuring adherence to tax

legislation. These consultants aim to provide expert advice and assistance in understanding

and implementing the correct tax policies and procedures.

VAT

consultants possess in-depth knowledge of local and international tax laws and

regulations pertaining to VAT. They offer specialized consultancy services to

companies to ensure full compliance and maximize the benefits of available

exemptions and tax incentives. Additionally, they provide guidance and training

to institutions to ensure the adoption of best practices in VAT management and

enhance tax efficiency.

The

role of VAT consultants is also significant for individuals who require

guidance and advice regarding VAT-related taxes. They provide advice and

guidance on complying with legal requirements and submitting necessary tax

returns. With their expertise and experience, they can assist individuals in

maximizing the benefits of available exemptions and tax incentives, as well as

achieving potential reductions.

In

Dubai, VAT consultants are well-versed in the local VAT framework and possess a

thorough understanding of the specific requirements and obligations of

businesses operating in the region. They stay updated with any changes or

amendments in the tax laws, ensuring that their clients remain compliant at all

times. By availing of the services of VAT consultants, businesses and individuals

can navigate the complexities of VAT regulations and minimize the risk of

non-compliance, avoiding penalties and legal issues.

In conclusion:

VAT consultants in

Dubai provide essential support to companies and individuals in navigating the

VAT landscape. Their expertise and knowledge of tax laws and regulations enable

businesses to ensure full compliance, maximize tax benefits, and optimize their

financial operations. Whether it's registration, filing, or strategic tax

planning, VAT consultants play a vital role in facilitating smooth and

efficient VAT management for entities operating in Dubai.

Visit our website to know more about our services:

OR

Call us Now and Talk with our expert for any VAT Related Query.

Comments

Post a Comment

“We really appreciate you taking the time to read our Blog. We look forward to seeing you again soon on our new blog post.”